Funding

-

STATE AID AND DEBT PAYOFF MAKE THE TIMING RIGHT

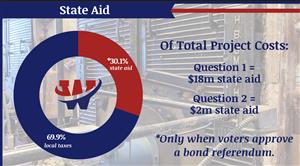

The time is right for Wall Township Public Schools to take the strategic step of bond funding. State aid could cover $20 million of these improvements, if voters approve that funding, and the school district is on the verge of finishing payments on past improvements.

Bond borrowing is a strategic fiscal move. While consumers might consider borrowing as a sign of poor planning and higher bottom-line costs, the opposite is true for public school districts in New Jersey. They stand to benefit from state aid that only comes with bond borrowing. Districts strategically plan to group projects into a bond referendum to take advantage of that aid – which can cover about one third of the costs – keeping project costs off the local tax bills. Wall taxpayers are already contributing to the state funds that provide this aid to school districts; it will only come back to Wall through a voter-approved bond referendum.

State aid comes from revenue collected statewide; it is only distributed to districts where voters approved bond borrowing. Voter approval would enable all of those improvements for the district, but not all of the costs would be on local tax bills.

TIMED FOR REINVESTMENT

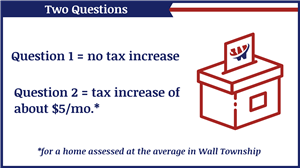

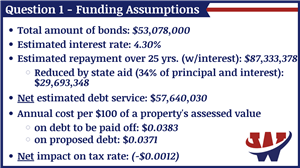

The combination of state aid and the district’s expiring debt are the key factors in timing. Wall has the opportunity to re-invest in its schools to make critical payments without paying more than the current debt tax rate. Projects in the second question would require a slight tax increase for the 25-year term of bond funding. The Board took action November 1 to place these questions on the ballot:- Question 1 (Projects total $53,078,733): They include must-do items such as roof and HVAC repairs, electrical and mechanical system upgrades, and restroom modernizations. The district was awarded the highest possible level of state aid of $18,046,769 for these projects. Voters are asked to renew the current level of debt payments to keep the district’s schools maintained with no tax increase.

-

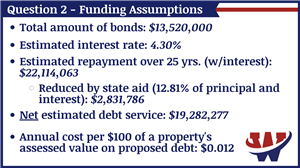

Question 2 (Projects total $13,520,475): They include additional work that is also necessary for our school buildings, plus important upgrades to expand use of Wall High School’s athletic facility. The state has committed $2,009,807 for these projects. The overall share of state aid for Question 2 projects is lower because sports-related enhancements rarely qualify for that funding, despite their importance to the community. For a home with the average assessment in Wall Township, these improvements would cost about $5 a month. (Read more about assessed value below.)

These projects would be smartly funded through bonds. State law prevents a school district from increasing its operating budget more than 2% a year, unless voters approve an increase. That budget covers day-to-day costs like salaries, supplies, and regular maintenance. Even if the district could find room in that budget to cover the costs of some of the bond referendum projects, borrowing with bonds is a strategic approach that allows us to tap into state aid that isn't available any other way.

-

Bonds are sold to investors to generate up-front funding. These bonds bring immediate funds to the school so they can make major improvements to their facilities. The investor gets interest as those bonds are bought back.

-

Property taxes and state aid buy back the bonds. State aid is contributed annually, as if the state is helping the district make loan payments. Property taxes make up the difference between what is owed and the state’s contribution.

Other factors make this the right time to act. Plans for a bond referendum were driven by an in-depth Facility Needs Assessment that projected what the district should do to avoid the risks and costs of emergency repairs or unplanned replacements.

Funding Estimates

Projects from the last voter-approved bond referendum are still valuable. In 1998, voters invested in the future of Wall Township Public Schools by approving a long-term bond to build additions at West Belmar Elementary School, Old Mill Elementary School, Wall Intermediate School, and Wall High School. That bond also funded other improvements at each of the district’s schools, as well as the 18th Avenue Sports Complex.

The debt from the 1998 referendum was refinanced in 2005, 2006, and 2007 to take advantage of falling interest rates. Those strategic efforts resulted in a savings of $1.2 million. The debt was again refinanced in 2015, resulting in an additional savings of $1.8 million.

Tax impact is related to a property’s assessed value, which is determined by Wall Township. The assessed value is different from, and usually less than, market value. A homeowner might guess at his or her property’s market value based on recent sales of similar homes; that can change day to day. In contrast, a property’s assessed value is found on the annual tax bill; assessed values do not change throughout the year. The mathematical average of all home assessments in Wall is $483,357. Find your home’s assessed value in this database.